|

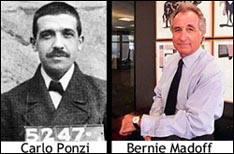

Bernie Madoff’s effort to capture “the world indoor record for fraud” continues. Losses attributed to Madoff have already hit $50 billion, eclipsing the $1 billion Enron losses. The damage inflicted by Madoff’s ripoff seems to worsen with every news cycle. Still, it’s not too early to learn some lessons from Bernie and his scheme’s namesake, Carlo Ponzi. |

The “Ponzi Scheme” is named after Carlo Ponzi, its perfector though not its originator. An Italian immigrant, Ponzi used his natural charm and good looks to inspire confidence in investors in his business, arbitraging International Reply Coupons. Outwardly his business appeared to have the potential for unlimited profits, so he had little trouble finding investors. Unfortunately the investors didn’t know something Ponzi did: There was a low ceiling on the profits investors could reap. Early investors usually made some money that came from new investment money rather than from actual profits on investments. When the number of investors plateaued and new investment money stopped, “profits” to even the early investors dried up, and the scheme collapsed.

There are two principal types of Ponzi Schemes. In the first, the schemer knows and understands his promises are lies. Promised returns can never be achieved. The schemer intends to get in, get the money, and get out of town before the suckers wise up. That was Carlo Ponzi’s plan, except he didn’t quite make it to the border before being caught.

Bernie Madoff appears to be the second type of Ponzi operator, one who starts with honest and good intentions. He truly believes he has a sure-fire, can’t-possibly-lose moneymaker. He fully intends to honestly and diligently repay and enrich all investors. But as the business progresses, he learns that he will never be able to fulfill all his promises of too-good-to-be-true returns. He begins to look for a miracle that will somehow undo the apparent damage to investors. There is no miracle, and again, the scheme collapses.

Saturday’s Seattle Times article headlined Ponzi schemers? They’re smooth operators is a good tutorial identifying the traits these con (as in, “confidence”) artists have. The traits apply to both categories of Ponzi schemers.

- Smart. Carlo Ponzi was “street smart” rather than educated. Today’s Ponzi clones may be graduates of prestigious schools such as Harvard Business School, the Wharton School of the University of Pennsylvania, Northwestern University – Kellogg School of Management, Stanford Graduate School of Business, etc. Their education leads them to believe the line separating legality and illegality is vague.

- Charming. They get along well with their prospective victims, often playing on the victims’ own ego and gullibility.

- Exude respectability. They are usually “well-respected pillars of the community” and all that rot.

- Instill confidence. Victims almost beg the schemers to allow them to become victims.

- Appearance of being trustworthy. Victims will trust them with their life’s savings.

- Command of finance. Even if they don’t have it, they sound like they do. They can talk a good talk up to the point they are confronted by someone who see’s through their scam. Even then, their reputation in the community may prevail over facts and common sense.

- Look successful. Have expensive homes, drive expensive cars, wear expensive clothes, etc.

- Prey on victims they know from their own religion, ethnic group, or community. It’s the “trust” thing. “Old so-and-so couldn’t be a crook. Why, he grew up in this community. I went to high school with him.” “Old so-and-so couldn’t be a crook. We go to the same church (or synagogue).”

- Appear to be generous givers to charities and other good causes. Again, it’s the “trust” thing. How could someone who gives so generously to the (insert favorite charity, community project, or social cause here) possibly be a crook?

Why didn’t the US Securities and Exchange Commission detect and stop Bernie Madoff? That’s the question every one of Madoff’s victims is entitled to ask and have answered. According to SEC Chairman Christopher Cox in his December 16, 2008, Press Release: Statement Regarding Madoff Investigation:

Since Commissioners were first informed of the Madoff investigation last week, the Commission has met multiple times on an emergency basis to seek answers to the question of how Mr. Madoff’s vast scheme remained undetected by regulators and law enforcement for so long. Our initial findings have been deeply troubling. The Commission has learned that credible and specific allegations regarding Mr. Madoff’s financial wrongdoing, going back to at least 1999, were repeatedly brought to the attention of SEC staff, but were never recommended to the Commission for action. I am gravely concerned by the apparent multiple failures over at least a decade to thoroughly investigate these allegations or at any point to seek formal authority to pursue them. Moreover, a consequence of the failure to seek a formal order of investigation from the Commission is that subpoena power was not used to obtain information, but rather the staff relied upon information voluntarily produced by Mr. Madoff and his firm.

Translation: The SEC ignored Madoff’s conduct. Why? If you have to ask, then re-read the Ponzi schemer traits listed earlier.

I suspect there’s more to the SEC’s failures than the SEC staff not telling the SEC Commissioners what Madoff was doing. It is inconceivable that some SEC staff members did not examine the information provided by outsiders and conclude that an investigation was warranted. If the press is diligent on this (and it probably will be since this surfaced during George W. Bush’s presidency), we may learn that efforts to initiate meaningful investigations were stifled by managers within the SEC. They may have confused nonregulation with deregulation.

That does not automatically mean the SEC’s managers were in criminal collusion with Madoff, who began his business in 1960. It is likely that preceding Chairmen of the SEC communicated their respective philosophies to their managers. Sometimes those communications are intentionally vague to protect The Boss. SEC Chairman Christopher Cox’s quick condemnation of the SEC staff was premature at best, disgustingly self-serving at worst.

It will be months before the Madoff scandal is unwound. Given the billions of dollars of damage done to investors, the apparent decades of dereliction of duty by the SEC, and the disinterest by the watchdogs of the press, we may never really know all we need to know.

The most brilliant part of the Madoff scandal is how his name is pronounced. I was saying, “Mad-off,” but it’s “made off” as in, “Bernie Madoff with all the money.”

Comment by Dan — December 21, 2008 @ 8:25 pm

i do not buy the simple “ponzi scheme” explanation. too many really wealthy, really big institutions. more will come out, lots more.

Comment by TheWiz — December 21, 2008 @ 9:06 pm

Bill, I’ve been wondering what a “Ponzi Scheme” was. Thank you for explaining it in such an interesting, historical perspective. A smart, smooth-talker who wil take you for a ride. Some things about human nature never seem to change.

Comment by mary — December 21, 2008 @ 9:12 pm

There is another set of problems in that various foundations and trust administrators violated a “fiduciary responsiblity”. The failed to diversify the holdings. Rank amatures in investing know you never have more than 4-5% of your total funding in a single stock or bond holding.

Nothing will protect you from the recent meltdown of the stock and financial markets but if you were adequately diversified you lost about 30% paper and probably still have more than the actual money you have invested left as a balance.

Greed is not good! Bears make money, bulls make money and pigs get slaughtered. A basic rule of finance 101.

Comment by paul — December 21, 2008 @ 9:35 pm

Thanks for all the comments.

I hoped the post would help people understand the traits of con artists. These are people who profit only because they have first won the trust and confidence of normally honest and decent people. Then they betray that trust and confidence to enrich themselves at the expense of their victims. In her Sunday Press column titled The slippery slope of greed and corruption, Mary uses this quote from an email she received from a local official talking about people’s motivation to serve on commissions and committees:

That local official is expressing “entitlement”, the idea that someone who gives is entitled to some tangible return on his giving investment. With that perception of entitlement, that official would no doubt see no problem at all with an LCDC commissioner using inside information (executive session, don’t you know) to steer LCDC projects in directions that would benefit him/her financially. The question then becomes, is that official deliberating and deciding in ways that benefit the entire community or in ways that primarily benefit him/her financially with any benefit to the community being secondary? At some point, the person may well breach the “duty of honest services” owed to his/her constituents.

Comment by Bill — December 22, 2008 @ 7:40 am

Wiz and Paul,

More has already begun to come out. Today’s New York Times has an article about the Fairfield Greenwich Group. The article is headlined Firm Built on Ties to Madoff Faces Tough Questions.

Yes, there will be more.

Comment by Bill — December 22, 2008 @ 8:55 am

At the November LCDC meeting, an inquiry was made about the Project Scorecard produced by Executive Director, Tony Berns. I thought it was to be presented last week during the Decemember LCDC meeting. I want to know which projects are proceeding, which projects have stalled and if any projects have been abandoned. This is Berns duty of honest services owed me a Kootenai County Taxpayer. For a six figure salary, you would think, Mr. Berns would at least be able to get this completed in a timely fashion.

Comment by doubleseetripleeye — December 22, 2008 @ 11:18 am

2c3i,

The only thing I see on the December LCDC Meeting Agenda is labeled LCDC Initiative Updates. The November meeting minutes said (I would use Berns favorite word “shared”, but I tend to get nauseated because of its overuse in the minutes):

I presume from your comment it didn’t happen.

Comment by Bill — December 22, 2008 @ 1:47 pm

Bill, your description of two types of PONZI schemes gives me thoughts that perhaps there is a third type, Unintended. It works like this. A business, size is of no matter, builds its fortunes from investors and suppliers who give generous credit terms. Suppliers always get paid and investors are rewarded as risks normally dictate, until one day when unintended circumstances diminish the fortunes and the creditors are not paid. It spirals downward until bankruptcy is the only way to save the business. The early investors/creditors got paid; the latter investor/creditors didn’t. Question: Is our bankruptcy laws actually a government sponsored PONZI scheme?

Comment by Gary Ingram — December 22, 2008 @ 4:46 pm

Wow. A Ponzi scheme. Think of it. Where you have new people join in and use their “contributions” to pay off people who’ve been in the system longer and paid in less. That works as long as you have new people to join and older people who, uh, stop taking payouts at even rates. And it would help to put all the funds into some kind of “lock box,” or at least claim to do so in order to appease the younger people who join. And who have no choice but to join. Who could think of such a scheme? Who would join it? I mean, not unless you had to. By law. But I’m just rambling.

Comment by Dan — December 22, 2008 @ 5:00 pm

Gary,

There is a legal concept called Mens Rea This legal concept seperates the stupid or ill fortuned from the criminal. It gets complicated. Bernie Madoff may well have started out as an honest businessman. He may have made a boneheaded trade. Then, in an effort to ‘fix’ that trade he may have drifted from ill-fated to stupid and then into criminal. In your example there appears to be no ‘mens rea’ or criminal intent, therefore no crime.

Dan, you seem to be pointing to Social Security as a Ponzi Scheme. Sadly, since legislators are sheilded by law from criminal liability for acts done in their official capacity and government as a whole has ‘sovereign immunity’, that clears them of the actual ‘Ponzi Scheme’ label, as they cannot be a criminal conspiracy.

Comment by Reality — December 22, 2008 @ 5:06 pm

Social Security a Ponzi scheme? Oh please!

Comment by Dan — December 22, 2008 @ 5:20 pm

Gary,

No, bankruptcy is not a Ponzi scheme. It may be an outcome. Some businesses fail because of bad business plans, changes in markets, undercapitalization, etc. Business failure is not automatically criminal. It can become criminal if the business’s failure was intentional to generate a profit (e.g., insurance fraud, tax evasion, or confidence games).

Madoff may have started out his business with honest and good intentions, but his business is a regulated business with rules, laws, etc. that prescribe some conduct and proscribe other conduct. Because compliance with existing regulation is a requirement he knew and had an obligation to know before going in, he had a duty to comply with the regulation. When he began to cover his tracks (e.g., keeping two sets of books, one for show and one for dough), he demonstrated a specific intent to violate the practices he acknowledged and agreed to follow. When he realized his business was failing and he allegedly used illegal methods to cover his failure to maintain sufficient assets, he crossed the line from bad business practices into criminal behavior.

There are two basic types of intent: specific and general.

In oversimplified terms, proving specific intent requires definitive proof that the accused intended to cause the harm the statute protects against. Some statutes explicitly require specific intent. For example, to convict the accused for homicide in most states, it must usually be shown that the actor intended for a death to occur as a result of his actions (malice). Specific intent is usually shown if the harm is a reasonably foreseeable outcome of his actions. For example, if someone sabotages an aircraft’s control systems and causes the plane to fall out of the sky and kill people, the actor would likely be charge with homicide as well as sabotage simply because death to an aircraft’s occupants is a reasonably foreseeable consequence of the plane falling out of the sky. The actor’s intent was to sabotage the plane, but specific intent to cause the occupants’ deaths would likely be imputed from the reasonably foreseeable consequence of his actions.

General intent requires less proof of intended harm. General intent can often be proven if the actor is shown to have known the act was prohibited, or if the actor is shown to have acted recklessly or negligently. Using the homicide example from the preceding paragraph, if the driver of a car strikes and kills a pedestrian in a crosswalk because the driver was talking on a cell phone rather than giving full attention to his driving, the driver’s actions may not have risen to the level of specific intent (to cause death), but it may have demonstrated sufficient general intent to charge the driver with a lesser degree of homicide or manslaughter (depends on the state law) because it was reckless or negligent.

Comment by Bill — December 22, 2008 @ 8:21 pm

Bill, my take on bankruptcy was somewhat in humor. I’m thinking, if I as a creditor was forced to accept less than what is owed or get nothing, that I feel that I was PONZIED.

Comment by Gary Ingram — December 22, 2008 @ 9:55 pm