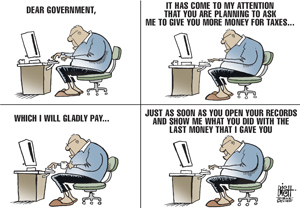

It’s late because I’ve been writing my newsletter, which I will post here tomorrow. But in the process, I found another of the free-to-use cartoons during Sunshine Week. It reminds me of the upcoming CdA School District Levy–

Any other Comments, Questions, Issues?

I’d urge your readers to watch the CDA TV 19 rerun of the LCDC meeting on Wednesday, March 19. Lucy Dukes’ Press article talked about the copshop in the Park, but she made no mention at all of the Magnuson, McHugh & company, PA, audit presentation that preceded the copshop portion of the meeting.

Now, I know that listening to auditors is about as exciting as watching a tree form its annual ring, but take the time. Their presentation only lasted about 10 minutes.

Point one: Kootenai County’s new and improved software (read: it’s really screwed up) is making it very difficult for taxing entities to know how much they will have to spend. It’s pretty difficult to write a financial plan and have annual audits done if you don’t know how much money you will have.

Point two: It’s reasonable and prudent for an agency’s accountant to recommend that checks be approved by more than one person and that account reconciliation be done by more than one director. It’s also possible that the accountant will recommend that internal check writing and cash accounting procedures be varied periodically so some internal crook can’t learn how to beat the procedure. When the company accountant recommends it, you pay them well for good advice. When the company’s auditor (as opposed to the accountant) recommends those same procedures after years of operation without them, you might rightly wonder if something is afoot.

Watch the LCDC meeting on TV and come to your own conclusions.

Comment by Bill — March 20, 2008 @ 7:45 pm

Bill, it was more than a suggestion by the Auditors. I was very surprised, watching at home, that they made such a big deal about the commissioners checking the cash of the agency, even after the regular checks were signed. That they should have a couple of people making sure the checks are the correct amount on the bank statement, after the checks have cleared, to insure that no untoward changes were made between the signatures and the bank. The Auditors went on the advise that procedures be rotated every 6 months, to prevent anyone from gaming the system. It was odd that they would go to such lengths. Makes me wonder if they are suspicious of something.

Comment by mary — March 20, 2008 @ 7:59 pm

Mary,

Two newsworthy events in recent history have caused accounting and auditing companies to re-examine their own corporate integrity and their professional commitment to give unbiased analyses and assessments to their clients:

Comment by Bill — March 21, 2008 @ 7:20 am