Our readers are off on an important topic: The tax impact of LCDC urban renewal on ALL property owners in Kootenai County. “Citizen” states that the additional tax burden to county residents is hidden in the tax bills, so it is harder not to “feed the beast”. There are many great responses to this comment, which I have copied from the other thread and pasted here, below.

Our readers are off on an important topic: The tax impact of LCDC urban renewal on ALL property owners in Kootenai County. “Citizen” states that the additional tax burden to county residents is hidden in the tax bills, so it is harder not to “feed the beast”. There are many great responses to this comment, which I have copied from the other thread and pasted here, below.

But on the subject of LCDC and how its tax impact can be explained or hidden by our officials, I must tell you about my meeting with Exec. Director Tony Berns, over a year ago. My question for Tony was exactly about the tax burden from urban renewal on city residents and all those in the county as well. Tony speaks in long sentences and confusing thought patterns. If you asked him if the sky is blue, he’d have a 15 minute response that would make you wonder what planet you were living on.

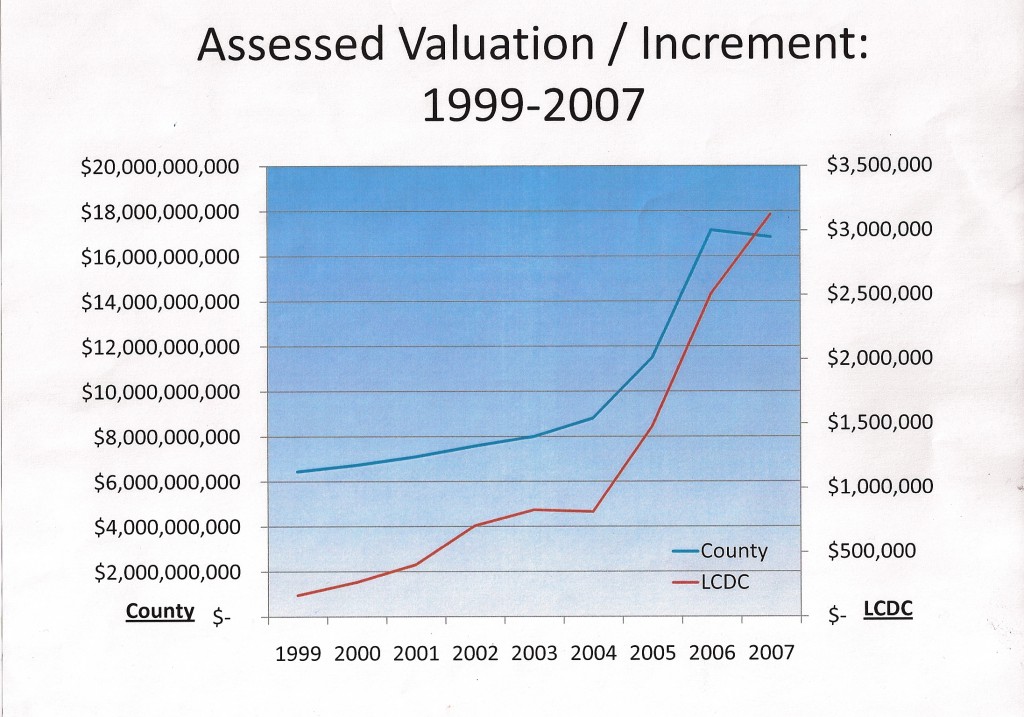

So, to ask Tony about a complex issue is inviting obfuscation. Not only did Tony deny ANY tax impact, he provided the following three-sided graph to thoroughly muddy the waters. I have a Master’s degree in science but have never seen such a graph, so I asked several much smarter, more research-oriented people about this one. They all scratched their heads in disbelief and could not understand how the two opposing coordinates could be compared without using correlating measurements. They all came to the same conclusion: two unrelated graphs must have been superimposed upon each other to make a final graph that looks impressive but means nothing. Our tax dollars at work!

But the ACTUAL assessed value of property within the URDs, from the latest numbers given by the Idaho Tax Commission as of Sept. 2009, shows right around 17% in the city of CdA and 6.5% in the county. Let me put it this way: IF you shut down urban renewal right now (and I am not advocating that) it would reduce your taxes by these numbers. So, even though LCDC wants to imply that NO development would have happened without them, it’s pure conjecture to guess which properties would have developed with or without urban renewal money. The bottom line is that it is costing us all money, and will until the year 2027.

Here’s the three sided graph:

Here are the related comments, copied from the other thread:

#

In my humble opinion the only way to clean up this corruption is to “stop feeding the beast.” Unfortunately, Habitat for Humanity has become part of the beast. If people stop sending them money then perhaps the national organization will investigate and help clean up a piece of the CdA corruption. The powers in CdA are a disgrace! They are the ones to be held accountable for declines in donorship. Acorn doesn’t get my money so why should the CdA Habitat for Humanity get my money?

Comment by citizen — October 12, 2009 @ 8:04 am |Edit This

#

“feed the beast”…love it! If only we could withold that portion of property tax that funds LCDC. With schools suffering along with other important groups, that $5 plus million going to “feed” LCDC is downright obscene! I all gets back to compliance. If absolutely everybody did it, there is nothing that could be done about it. Non compliance to bad law is exactly how this country was born. Apparently, I’m fomenting revolution..whoo hoo!

Comment by Faringdon — October 12, 2009 @ 9:29 am |Edit This

#

citizen and Faringdon,

As I indicated in my post, I believe that as a IRC Section 501(c)(3) tax-exempt organization, Habitat for Humanity-North Idaho needs to be examined by the IRS to determine if it directly or indirectly participated in or intervened in any political campaign on behalf of or in opposition to any candidate for elective public office in Coeur d’Alene. That is the best way to determine if there was a problem. If there was, then it needs to be fixed so the public’s trust and confidence in HFH-NI is restored. Obviously the Press article generated some concerns, and rightfully so. There are simply no local authorities with the authority, legal jurisdiction, or the credibility to conduct an inquiry and compel any needed corrections. The most important outcome is for any problems with HFH-NI to be corrected.

Comment by Bill — October 12, 2009 @ 10:21 am |Edit This

#

I understand that the LCDC portion of the tax bill is not broken out on the tax bill. Is this true? This makes it harder not to “feed the beast”.

Comment by citizen — October 12, 2009 @ 7:12 pm |Edit This

#

citizen,

If you live inside one of Coeur d’Alene’s two urban renewal projects (the Lake District and the River District), your assessment notice will show it.

If you live outside one of two projects, you will not be told (because the treasurer cannot precisely calculate) how much of your tax assessment goes toward making up for what the LCDC skims off.

The abuse of urban renewal in Idaho is the ultimate scheme: Out of one side of their mouths they tell you it doesn’t add to your tax payments, yet out of the other side they say “it depends” on some assumptions about the future value of the property after consultation with Madam Olga and her ouija board.

Comment by Bill — October 12, 2009 @ 7:28 pm |Edit This

#

Pressure needs to be put on the Kootenai County Commissioners to help clean up this mess of rising taxing on us in the county for the short fall to county taxes due to LCDC. Instead of taking the forgone taxes, our County Commissioners should be screaming to the state about the tax shortfall due to LCDC. Currie, Piazza and Tondee need to work for us and stick their necks out on this issue. This has been a long time frustration of mine and I have told each one of them my feelings on the subject. Perhaps, they are afraid of losing city voters.

Comment by citizen — October 12, 2009 @ 8:22 pm |Edit This

#

Citizen raises a very legitimate point about the county commissioners getting involved on the questions raised about urban renewal tax diversions. Most all of the critical analysis of the impact on county taxpayers has been directed towards the appointed board members of LCDC and the elected officials of the City of Coeur d’Alene. It’s time for the county commissioners to get involved. It’s time to hold their feet to the fire, as well.

Comment by Gary Ingram — October 13, 2009 @ 9:10 am |Edit This

#

Bill, isn’t the portion of the PT that goes to LCDC a percentage of the total? If you live outside of CDA and it doesn’t show on your bill, couldn’t you figure the amount by using that percentage figure? My Ouija board isn’t talking.

Under the “didn’t see that coming” heading, Mikey Kennedy leads in contributions…big surprise…not! I find it interesting that Steve Meyer and St. Charlie the Nipp are not show as contributors. Call me a cynic, that just doesn’t pass the smell test. On the lighter side, his in-laws made a substantial contribution. Clearly, they don’t want to end up supporting those 7 children.

Comment by Faringdon — October 13, 2009 @ 9:29 am |Edit This

#

Faringdon,

If you live inside one of the two LCDC projects, it does show up on your tax bill.

If you live outside one of the two LCDC projects, you (or the county assessor or county treasurer) should be able to tell you by what amount or percentage your taxes have increased to compensate for what the LCDC skims off. They should be able to, but they can’t — unless they make some assumptions that may or may not be valid. That’s the beauty of the scheme the LCDC is running on the taxpayers of Kootenai County.

Here’s a link to Kennedy’s first campaign finance statement. There will be three more filed. On 09/25/09 Charlie and Susan Nipp gave his campaign $300. On 09/03/09, Ryan and Teri Nipp gave $100.

There was something else interesting. Clearly Kennedy’s trip to Boise on August 20 to collect campaign money from the folks there was productive. Note the contributions on 08/20/09, roughly just over $1,000. Note, too, his expenditure for $234.20 to Southwest Airlines on 08/20/09.

Comment by Bill — October 13, 2009 @ 9:59 am |Edit This

#

Gary: “…the treasurer cannot precisely calculate how much of your tax assessment goes toward making up for what the LCDC skims off.”

That’s because it would be purely theoretical in nature for the Treasurer to know that amount. It is a fact that the increment going to LCDC might not have been created in the first place without their participation in the District’s projects. Clearly, there would be little or (more likely) no development on the old mill site that is now Riverstone. The cost to acquire and clean up the site (over $9/square foot) made it prohibitive to develop without incentives from LCDC.

So, a strong case can be made that the taxing agencies not currently getting the revenues likely would be getting little or none of them now anyway. As it is, the County and other taxing districts will in a few years see several million dollars annually added to their budgets when LCDC’s districts are retired.

I believe firmly that it will have been worth the wait.

Comment by JohnA — October 13, 2009 @ 10:06 am |Edit This

#

Bill…my convoluted mind is in overdrive. Exactly how can it be “theorectical” for the treasurer to know the amount? If that is so, then exactly how is the amount, given to LCDC, “calculated” after the collection of property tax. It is an impossibility for the treasurer NOT to be able to explain to the taxee how much of the tax revenue goes to LCDC…and then be able to apportion than money to LCDC. The explanation is nonsense.

Comment by Faringdon — October 13, 2009 @ 10:18 am |Edit This

#

I’ll answer, Faringdon. It’s theoretical because only new construction created in the urban renewal districts goes to LCDC. Without knowing LCDC’s impact on new construction, it would be impossible to calculate how much other entities would be or would not be getting today. In any event. those entities are guaranteed to receive those new dollars once LCDC’s Districts end.

Urban renewal is nothing more than an investment in the future, an investment that will be as lucrative to local governments in the future as it is to cities all over Idaho today.

Comment by JohnA — October 13, 2009 @ 10:44 am |Edit This

#

“the County and other taxing districts will in a few years see several million dollars annually added to their budgets when LCDC’s districts are retired”.

Comment by JohnA — October 13, 2009 @ 10:06 am

The Lake and River Urban Renewal Districts will last a maximum of:24 years each.I think that’s far too long IMO.Post Falls retired the district that Harpers was in after 10 years.Why does CDA’s districts have to last 24 years?

Comment by kageman — October 13, 2009 @ 11:52 am |Edit This

Comment by mary — October 13, 2009 @ 12:09 pm

It’s funny to think of JohnA’s “few years” until the huge, oversized districts here are retired. “Few years”? I’ve never heard 11 and 17 years described that way before! It’s out to

2021

for the downtown district and all the way to

2027

for the River district.

Comment by mary — October 13, 2009 @ 12:13 pm

I’ll add my last comment here from the other thread too.

I don’t believe that LCDC or any Urban Renewal Agency should be in the business of:helping to finance residential construction projects;

like condos for part-time residents etc.Why?Because,it gentrifies CDA and other areas;as LCDC helps to raise property values significantly.

The Idaho State Legislature needs to

revisit some Urban Renewal laws IMO.

Comment by kageman — October 13, 2009 @ 12:07

Comment by kageman — October 13, 2009 @ 12:15 pm

Mary, I thought the Lake District was going to be retired in 2021?Either way, I’ll probably be in the old folks home, before these Urban Renewal Districts are retired.

Comment by kageman — October 13, 2009 @ 12:24 pm

Oops, Kage, I had a senior moment. I’ll fix it right away, thanks for the heads up.

Comment by mary — October 13, 2009 @ 1:06 pm

Well it is not a 3 sided graph. As presented it certainly is not clear but it is a timed function of change in assessed property value for the county and change in the increment tax collected for the LCDC from the years 1999-2007. Assessed value for the county rose from just over $6 mil to just over $16 mil, then leveled off while the LCDC tax increment (not it’s assessed value but the tax collected) rose from roughly $250K to about $3.25mil. What I find most noteworthy is the precipitous slope in the LCDC tax income showing it doubling each 1.5 years starting in 2004 and not at all abating. But you can literally say from this data that from 1999 through 2005 the counties assessed value increased by 266% while the tax collected for the LCDC rose by 1300% from 1999 to 2007 (mostly from 2004 to 2007).

What is wrong about this graph is that it is mixing variables. In other words the data should be the same for every function on the graph. It should be the property tax collected or the assessed property values and not any combination of the 2. As it stands it is literally a graph comparing apples to oranges. Someone should do a graph depicting the property tax collected from 1999 through 2009 for the city of CdA, Kootenai County and the LCDC.

BTW I consider a “3 sided” graph to actually use 3 dimensions showing related functions displayed on the X, Y and Z axis. For example you could graph temperature versus relative humidity as a function of time to depict how atmospheric moisture varies during a 24 hour time period. It comes out looking like a volume because of the 3 dimensions.

This graph was 2 dimensional but required 2 sets of data bars because, as I said, it compares two disparate functions. I had a professor who drilled into me that any graph or illustration had to be so clear that it could be understood in the absence of the body of the text. That does presume that the reader is versed enough in the acumen to comprehend both the paper and its data illustrations.

But this graph is just plain poorly done and is not really related to the inquiry made (surprise!). There is an answer probably to be found at city hall and not the LCDC. Somebody at the city decides how much property tax shortfall needs to be rectified by adding additional taxes to properties outside of the LCDC (they may also increase the taxes within the LCDC too, for all I know). We do know that the LCDC roughly siphons off about 20% of CdA property taxes. I have no idea how much of that the city seeks to recoup. I have no idea what percentage the LCDC takes from the county tax base and that would more difficult to determine especially with the added NIC tax burden.

Sorry for the length. I hope I made some sense of this mess even though I provided no real answers.

Comment by Wallypog — October 13, 2009 @ 2:15 pm

Got it Wally! Simply put, it’s a shell game.

In my experience Tony Berns type bibble babble is in aid of making the questioner go away. Has anybody ever tried just sitting there quietly and looking at him until he speaks clearly.

I was under the impression that the LCDC “graft” was to be separated from school levies. Was that simply buried in B oise? What is the name of that truly horrible woman legislator in Boise who heads the finance committee? I understand she is completely responsible for sinking any legislation that would change urban renewal income.

Comment by Faringdon — October 13, 2009 @ 3:12 pm

Thanks, Wallypog, your explanation is crystal clear to me, compared to the logic of the graph. You said it well with, “What is wrong about this graph is that it is mixing variables…it is literally a graph comparing apples to oranges.

Comment by mary — October 13, 2009 @ 4:36 pm

Where does it stand now in regard to LCDC paying school tax?

One of the main reasons I will not vote for the jail is because our Kootenai County Commissioners and Rocky Watson will not go after LCDC for the money that is skimmed away from services. Where are their backbones? It is too easy for the County Commissioners to go after the “foregone taxes”, increase levy rates, and float bonds for jails we can’t afford…. And yes, I have said this directly to Tondee, Piazza and Currie. They need to go to Boise and lobby for the Kootenai County taxpayer.

Comment by citizen — October 13, 2009 @ 7:08 pm

One correction to my post from yesterday. I mistakenly referred to the counties assessed valuation from this goofy graph as ‘millions’ when I should have said ‘billions’. I suppose this could also be behind Berns reason for presenting the data in this manner. He was looking to show how much value the areas property holds versus how relatively little the LCDC receives in increment tax income. He was trying to employ the “we get a tiny drop from the huge bucket” argument. The only valid information to be wrought from this is what I already mentioned. It would be hard to dissect out how much (or little) the LCDC impacts the property taxes in the county. Maybe that was all Berns was trying to show and in this he is correct. But, the impact is NOT zero, it is just hard to quantify.

The better graphs would be 2 separate graphs. One graph showing the property tax collected for the city, county and the LCDC since 1999. The other graph to show the assessed property values for all three entities over the same time period. The most interesting segments of these graphs would be how these numbers change as the property valuation drops starting in 2005. We can already see from Berns graph that the LCDC tax income does not decline whereas the assessed values in the county actual plateau and start to decline starting in 2005. But did the actual taxes collected from the county decline as the assessed values decline? With these 2 graphs we can compare how these entities manipulate property taxes income versus assessed values. We know they modify these numbers for many reasons but we don’t know how much. What they may reveal is that the citizens living in CdA are impacted more than those living in the county and this could be inferred as being due to the LCDC being a greater factor on a smaller population.

You could also collect this same data from other Idaho cities and counties, with and without urban renewal districts and compare the relationships.

Insofar as Tony’s graph I could also make up my own. I would graph the change in the average CdA citizens income versus the rate of change in the LCDC’s income since 1999 (corrected for inflation, of course). I would have to explode the scale in order to keep the citizens change in income even visible on the graph. Berns is such a Putz.

Comment by Wallypog — October 14, 2009 @ 7:45 am

Wallypog, the property tax increment expected by LCDC for this year alone is $5.2 MILLION dollars. This is according to their own information. The graph, above, shows 2007’s tax increment at just over $3 million. See how their tax skim has increased in just the last two years? If the graph was current for today, the red line would be going almost straight up…in a down economy.

Comment by mary — October 14, 2009 @ 8:49 am

Let me enter through another door, if you will. I’m not trying to be obtuse…but somebody quantifies it in some way. Or does Tony (Putz…I love it) Berns just say I need X and they give it to him. That wouldn’t surprise me either.

As the LCDC amount is listed in the CDA bills,why couldn’t the rest of us “demand” that some way be found to list it on all bills. Bear with me folks…I believe an argument could be made for discrimination against those of us who have the tax dollar taken without explanation. I told you my mind was convoluted.

An interesting article this morning about bringing some baseball team to CDA….BUT they need a stadium costing “millions” of dollars. “They” art not sure how they will finance this boondoogle, but “they” have been talking with council members and business people. This is giving me a twitch!!

I noticed that Mikey received donations from Minnick. Does Minnick donate to every piddly little city candidate in Idaho?? Riiight!

And lastly, a really sad commentary. The Press poll asking if Jim was fired for financial or political reasons, showed that most believed political. BUT, the sad part is that some 40% of the voters, voted “don’t know/don’t care.

Comment by Faringdon — October 14, 2009 @ 8:55 am

Mary: “…assessed value of property within the URDs…around 17% in the city of CdA and 6.5% in the county. IF you shut down urban renewal right now (and I am not advocating that) it would reduce your taxes by these numbers”.

That statement is conjecture on your part, Mary. If the URDs ended today, the $5.2 million collected annually would be distributed to all affected agencies such as the county, city, four highway districts, NIC, etc. It would be treated as ‘New Construction’ by the State Tax Commission, thereby allowing each entity to raise their budgets by that amount. Now, you can make the point that taxpayers could bring pressure on their elected officials to use the money to ‘reduce…taxes’ but nothing in the current law would require them to do that.

We witnessed what Post Falls experienced when the Harper’s URD was retired and the city got a budget boost of $400,000 annually. They used the money wisely I thought, not to reduce taxes but to build a badly-needed police station, funding the cost over several years. I’m not sure how the other entities used their windfall but I’m guessing they did not reduce taxes.

I appreciate the opportunity to discuss URDs but I think the facts are an important component to viable dialogue on the subject. Thanks for providing the forum.

Comment by JohnA — October 14, 2009 @ 10:29 am

Considering how the projects within the LCDC are languishing the land may return to the city in worse shape than when they were established to cure the ‘blight’. There can be no doubt that this CdA gov’t would not ever voluntarily miss an opportunity take full advantage of any income stream. CRRRRack that whip! Whip it good!

Comment by Wallypog — October 14, 2009 @ 12:49 pm

JohnA, how does the bill, sponsored by Sen. Jim Hammond of PF a couple years ago, impact the process you described in #13?

Comment by mary — October 14, 2009 @ 6:30 pm

Mary, I believe you are referring to legislation that clarified an issue involving new construction. As you know, local governments are allowed to add to their budgets each year a 3% budget increase, plus the value of new construction. If they opt not to do that, those funds accrue in their Foregone Tax Account administered by the State Tax Commission. In my nine years as Finance Director at CDA, for example, we accrued over $1 million in Foregone Taxes because we opted not to take the 3%.

The issue clarified in recent years was that County Assessors allowed the value of new construction in URDs to be reflected by local governments as well.

This meant new construction dollars going to URDs were also allowed to be shown in budget increases to local governments (i.e. cities could increase their budgets even though those dollars flowed to the URD.) That resulted in taxes increasing outside of URDs, and that was not right.

Now, local governments can no longer add new construction in URDs to their annual budgets, which is right and fair to taxpayers. They are instead allowed to add that new construction to their budgets when the URDs are retired, which won’t impact existing taxpayers and results in the windfall I described earlier in this thread.

Thanks for the chance to comment on this badly-needed law change, to which we can thank local legislators like Sen. Hammond for providing.

Comment by JohnA — October 15, 2009 @ 9:16 am

Thanks, John, for your good information. Let me propose a scenario and maybe you can tell me if it could ever come true in the future:

Here’s the scene: The URDs close as they are planned to do. The $250,000,000 (estimated) in property Tax Increment goes to the city, county, etc. They decide to KEEP it because they legally can, and they don’t lower anyone’s tax rates. Their budgets are swollen by all this money, and that big budget becomes what’s called their “base” budget. So the next year after that, they can increase the huge, enormous budget by another 3%, which is the legal limit. Only this time, the 3% is of a much larger total amount. And they can do this year after year after year—–without giving the taxpayers ANY property tax relief.

They would never have to ask the voters to approve any projects ever again; they would have tons of money and we’d be paying through the nose.

Is it possible?

Comment by mary — October 16, 2009 @ 3:30 pm

Excellent question Mary. Hope you have better luck than me, getting a response from Austin on a very pointed question. He’s been good about that previously, so maybe he’s out of town and I just need more patience.

Comment by Gary Ingram — October 16, 2009 @ 8:31 pm

Did anyone read the “My Turn” article this morning on LCDC. Appreciated the effort…uhhh, but talk about a convoluted explanation. Anyone here with more expertise than I have, like to translate that into clear speak!

Comment by Faringdon — October 17, 2009 @ 9:58 am

I also read Scott’s article. I question a couple of statements. The Salvation Army Kroc center is not “an entirely public project” although it is available for public use, I believe, usually for a fee. I wonder if the fake lake, located on river front property, was nothing more than a place in which to cover junk used to fill a hole and was used as a sales gimmick. I cannot remember Doug Eastwood’s estimate for maintenance but think it was not cheap. When turned over to the city for maintenance, the fake lake, fountain and park will be paid by the taxpayers.

Comment by Susie Snedaker — October 17, 2009 @ 10:35 am

Mary, you are correct that the agencies receiving the $5.2 million annually (which is likely to grow even more during the remaining life of the URDs) would be new construction eligible to be added to their budgets. Then, it would be subject to the 3% increases annually. In a way, it’s better for taxpayers that those dollars are going to LCDC because if those dollars were going to the other agencies today, the 3% would compound every year on the current $5.2 million (or be added to the Foregone Tax Balance if those agencies opted not to increase their budgets by the full 3% each year.)

And, Gary, I’m sorry I must have missed your question. Please restate it and I’ll try to respond.

Comment by JohnA — October 17, 2009 @ 11:15 am

John Austin, please read post #27 on…”If It Was Political”…

Comment by Gary Ingram — October 17, 2009 @ 4:05 pm