Friday’s Coeur d’Alene Press published an article headlined Prosecutor denies activist’s appeal. One comment appended to the article’s online posting was from a commenter using the pseudonym “progressive.” Referring to the lawsuit Larry Spencer, Tom Macy, and I filed against NIC and the NIC Foundation, “progressive” said, ” I I just wish that the taxpayers could counter sue these sue happy clowns for all of the legal costs that they have cost us.” Our lawsuit revealed that NIC had paid $6,720,029.87 in rent on land it already owned and that NIC had made no effort to recover the overpayment.

Nevertheless, “progressive” raised a good issue for discussion: If our lawsuit against NIC and the NIC Foundation was not the appropriate action for us to take, what should we have done instead?

It amazes me that the progressive left gets so uptight when those who are not in their camp sue the government, specifically sue the government to get the government to obey its own laws. They whine that “tax dollars are being wasted.”

I would argue that no tax money is being wasted when the issue is compliance with the law.

The ironic thing is that the same members of the progressive left seem to have no problem with the government dumping billions if not trillions of the same tax dollars into feel-good government programs that nearly 100 percent of the time cause more problems than they ever attempt to solve.

Comment by Dan — July 9, 2011 @ 11:42 am

I’d say “progressive” has not read and understood the “Lease Agreement” nor does s/he have any concept of what our lawsuit was about. In that regard, “progressive” is not alone. If more people understood that the North Idaho College Board of Trustees actually paid $10,287,420.19 in “rent” when they should only have paid $3,567,390.32, they might be concerned about the competence of the NIC Trustees as well as the Foundation’s Directors. Where did that money go? What did NIC get in return for the $6,720,029.87 overpayment that went to the Foundation? Why didn’t NIC try to get it back, and why hasn’t the Foundation returned it. Where did that money go? Every dime of it was public money.

But I go back to the original question: If our lawsuit against NIC and the NIC Foundation was not the appropriate action for us to take, what should we have done instead?

Comment by Bill — July 9, 2011 @ 4:03 pm

I thought what Progressive was talking about is already in place. I thought, and I could be wrong, that the party that wins a lawsuit can ask the judge to award legal costs if the judge deems the case to be frivolous. Correct, or am I thinking of something else?

Comment by patrickh — July 10, 2011 @ 7:14 am

patrickh,

Depending on the state, the prevailing party can ask the court to award attorney fees (as distinguished from costs). Costs are usually a reimbursement to the court for its costs incurred in hearing the case, often a few hundred dollars or less. The prevailing party can request the court to require the non-prevailing party to pay the prevailing party’s attorney’s fees. When a court awards attorney fees, it is often a recognition by the court that the action had no legal basis or legal merit in the first place, that it wasn’t brought seriously or that it had no reasonable purpose. The term usually used with that definition is “frivolous.” That term is sometimes used carelessly by people who do not understand it has a specific meaning and interpretation in law.

Notice that I did not use the term “winner” or “loser”, because neither term is appropriate. Many and maybe most civil actions are brought because there are issues of fact and the application of law in dispute. Our system of laws provides the courts as a means to resolve those disputes. Our lawsuit against NIC and the Foundation was one of those. NIC had requested the court to award attorney fees on appeal. By not awarding attorney fees to NIC, the courts were acknowledging that the issues we raised had a legal basis and merit and were worthy of adjudication, that our lawsuit was not a waste of the courts’ time (frivolous). If the outcome of a lawsuit provides the public with more information than it had before and makes the public better informed about the conduct of its public officials, then the public is always the “winner”.

So again I’d ask “progressive”, if you believe our lawsuit against NIC and the NIC Foundation was not the appropriate action for us to take, what do you believe we should have done instead?

Comment by Bill — July 10, 2011 @ 7:49 am

Bill, I understand your concerns, to a point, but here’s what I don’t understand about it: You acknowledge that Marshall Chesrown had a purchase price of $10 million for the property. Why would you expect NIC to pay only $3,567,390.32 for a piece of property that cost three times that much to acquire? If I’m missing something, please forgive me but I am confused on that point. Thanks.

Comment by JohnA — July 10, 2011 @ 9:11 am

JohnA,

If you believe NIC and the Foundation, NIC was not buying the property; the Foundation was the buyer. NIC was only renting it from the Foundation. Therefore, if you believe NIC, NIC really shouldn’t care what the acquisition cost to the Foundation was. NIC was nothing more than a renter — if you believe NIC. All the money NIC actually paid ($10,287,420.19) was rent, and a substantial amount of that was prepaid in anticipation of NIC “renting” the property until July 22, 2013. But the Foundation, on its own volition as the property’s owner and NIC’s landlord, paid off the balance on its loan and interest to Mountain West Bank on December 3, 2010. That payoff by the NIC Foundation triggered the provisions of the “Lease Agreement”, page 7, paragraph 20, which required the Foundation to immediately deliver fee simple title on the land to the College, and it also required the College to accept title to it. On December 3, 2010, NIC became the owner of the land, but NIC had already prepaid rent through July 22, 2013. NIC had only rented the land for 499 days, but it had (pre)paid rent for 1,461 days. By our calculations, NIC had then paid rent in the amount of $6,720,029.87 on land it already owned. NIC should have demanded that amount be refunded to NIC, and the Foundation should have readily refunded it.

Comment by Bill — July 10, 2011 @ 9:38 am

Why did NIC prepay the rent? Wouldn’t it have been cheaper for NIC simply to wait it out, pay the rent as it was due? What was the rush?

Comment by Dan — July 10, 2011 @ 10:56 am

Dan,

Those are all very good questions. Since NIC was only a renter and since NIC says it has to raise fees and tuition and beg for money from Warren Buffet to make ends meet, a logical person would ask why the NIC Trustees would break the piggy bank to prepay rent. That $6.7 million in “rent” NIC prepaid and overpaid to the Foundation could have been used to enhance a lot of NIC’s vocational training and education programs.

Bring that down to a personal level. Suppose you were renting an apartment and you got the landlord to agree to lease it to you for four years but with the understanding that you could back out with one months notice. Would you pay 98% of the four year’s rent in a little over one year? But suppose you did for whatever reason decide prepay 98% of the rent. After a little over one-third of the way into your four-year lease, you decide to walk away from the lease. Would you not try to recover the rent for the remaining time on the lease? In fact, would you not have written a prepaid rent recovery provision into the lease agreement? Any prudent person would. Certainly anyone who is the steward of public money and who is obligating public money would. Or should have.

Comment by Bill — July 10, 2011 @ 11:17 am

Dan, the arrangement required the payment of interest. It seems reasonable for NIC to pay the principal and save the cost of the interest, just as soon as they were financially able to do so.

And, Bill, where would the Foundation have gotten the money for the property without NIC’s arrangement? It seems to have been predicated on NIC making the payments and then receiving the property. I know you don’t like the arrangement and making a case is the way to have a legal opinion granted on it.

Comment by JohnA — July 10, 2011 @ 12:40 pm

JohnA,

NIC’s payments to the Foundation included the principal and interest payments the Foundation had to make to Mountain West Bank on its loan to buy the property. Go to page 7 of 17 in my report and look at the tables which show the dates and amounts of NIC’s payments to the Foundation and the Foundation’s payments to Mountain West Bank. It is noteworthy that the IRS says that if a periodic payment includes an interest component, it is more likely a purchase than a lease.

As for where the Foundation would have obtained the money — why did the Foundation even need to be involved? The NIC is statutorily authorized to purchase property. That was never disputed. But to buy it, NIC must comply with the Idaho Constitution, Article VIII, Section 3 if the funding will extend beyond one year’s budgetary appropriation. Article VIII, Section 3 gives NIC two methods to enter into a debt or liability extending beyond one year. The first method is to ask voters to approve the long-term obligation. That requires 2/3 of the voters approve. The other method is to ask a District Court judge to judicially confirm the long-term obligation as meeting the ordinary and necessary provisions of the Constitution and Idaho statutes. All the NIC Board of Trustees had to do was get voter approval or judicial confirmation, and we would never have to have filed the lawsuit.

Comment by Bill — July 10, 2011 @ 1:10 pm

The only justification I can come up with is to conceal the details of the Chesrown deal from the general public. If NIC — and the NIC Foundation — were being honest with the public and the taxpayer, then they would have made every effort to ensure that this deal was done transparently and according to the law. Instead, it’s my observation that they took great pains and effort to hide information. Being sneaky does not instill trust.

Comment by Dan — July 10, 2011 @ 2:09 pm

The lease game has been played in KC for years – the new Courthouse was “bought” that way – and has Ron Rankin’s name on it!

Comment by justinian — July 10, 2011 @ 5:28 pm

Justinian,

There can be legitimate lease and lease-to-buy options. A lease is not inherently illegal. Mitchell decided the NIC-Foundation “lease” was a legitimate “lease,” so we said fine, then NIC and the Foundation should have to live by the terms of the “lease.” After all, they agreed to the terms. If it was a lease, then all the money paid by NIC to the Foundation was rent and nothing else. Those terms did not explicitly spell out the periodic payments, but that was easily calculated from the “Lease Agreement.” Calculated to the day, NIC is due a refund of about $6.7 million from the Foundation. That is “rent” NIC inexplicably prepaid and ended up overpaying. Ultimately, they have screwed the Kootenai County property tax payers to the tune of about $6.7 million.

Comment by Bill — July 10, 2011 @ 5:55 pm

Its late and I’m tired but let’s look at the deal with a different light. Let’s say the rent , in Bill’s example in comment 8, was to be applied as option money for a lease option to purchase, wouldn’t you as the renter insist that the rent paid, in any form, be applied to the purchase price. I realize that that wasn’t the deal but if all those funds were transferred to the seller regardless of the stipulations there should be some “boot” for the funds.In this case the $ were just transferred.$6M without any return.

And as to John A.’S comment #5 and i spent over twenty years in gathering entitlements for development projects and saw many developers pay way more that 3 times the true value of land “on the come” and loose. That’s the development game no matter how many “good” deals you did prior. Chesrown sucked the players right in and sold them a bill of goods. The eventual owners of Blackrock didn’t bite the big Kahoona, John A.

Comment by Ancientemplar — July 10, 2011 @ 9:03 pm

If the city, the NIC Foundation, NIC and those in the LCDC pulling the strings all had enough gumption to worm together this ‘pseudopurchase’ then they should indeed have to answer in court for how it actually went down. In the literal sense Bill is dead correct. A justice system that turns a blind eye to such obvious quasi illegality is no justice system all all. It is nothing more than small town cronyism with big time money. Our money. John A – It was a “LEASE” and rents were overpaid and refunds are due – PERIOD. It was really nice of the Foundation to donate that land to the college. Hope they can find the real money to pay for it and not expect to steal it from the taxpayers via our junior college.

Comment by Wallypog — July 11, 2011 @ 5:45 am

Ancientemplar,

You made good observations. Unquestionably, NIC and the Foundation agreed to pay too much for the land at $10 million. But it wouldn’t have mattered. If Chesrown had asked $15 million, NIC and the Foundation would have likely paid that, too. Political subdivisions of the state always pay too much for land. It’s easy for them to spend other people’s money.

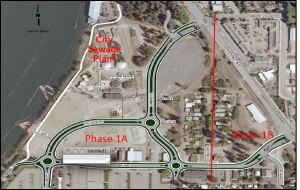

I couldn’t find any evidence that Chesrown sold them a bill of goods, though. Granted, he put the price at $10 million, but NIC and the Foundation could have negotiated on that — except for one thing: They were desperate. In pages 1 – 3 of my report, the Parties and Other Parties had been working toward an orderly acquisition of the property. When Stimson abruptly decided to close up shop and sell the land, it caught the Parties unprepared. Chesrown was not one of the original Parties or Other Parties as far as I could tell. When he came in and made an offer to Stimson for the entire 106-acre bundle (which included the 17 acres by the sewage plant), I believe the City, Hagadone Corporation, the LCDC, and NIC panicked. Chesrown was going to own land they coveted, and his intended uses for it might not have been exactly compatible with theirs. Consequently, they needed to come up with the $10 million by whatever means necessary.

Comment by Bill — July 11, 2011 @ 7:10 am

Wallypog,

You have very succinctly summed up exactly what happened.

If we accept District Court Judge John T. Mitchell’s decision that the “Lease Agreement” was not a sham to conceal an illegal purchase, that it was truly a “lease,” then the Foundation was a lessor/landlord and NIC was the lessee/tenant. There was no other relationship between them. All the money NIC paid to the Foundation was rent. There were no provisions or requirements in the “Lease Agreement” for any or all of it to be applied toward the purchase of the land.

In fact, it is conceivable that after NIC made its final scheduled payment and if the Foundation had not paid off its loan to Mountain West Bank, NIC could have been evicted and would have lost the $10,444,804.12 in “prepaid rent” it had already paid. It was the Foundation’s final payment on the loan to Mountain West Bank that triggered the transfer of title from the Foundation to NIC — nothing else. The “Lease Agreement” contained a provision that allowed NIC to purchase the land if the Foundation defaulted on its loan, but if the Foundation had failed to make its last payment of about $1.074 million, then NIC would have to make that payment on top of the $10,444,804.12 it had already “prepaid” as “rent”.

If the court had enforced the “Lease Agreement” according to the law, then NIC should have paid the Foundation only about $3.6 million in rent for the 499 days it truthfully was a renter. The remaining $6.7 million should have been refunded. Thus, the Foundation would have been fulfilling its purported mission to support NIC by refunding the $6.7 million to NIC and paying that same amount out of its own assets to Mountain West Bank. You have correctly characterized what the Foundation should have done as a donation, a gift, to NIC.

Comment by Bill — July 11, 2011 @ 7:33 am

It would be interesting to know if they wrote an addendum property sales contract at NIC’s early termination of the lease legally defining the process as a sale ‘at that time’ in consideration for all dollars paid, up front, as due and in the absence of leasehold property occupation???

Comment by Wallypog — July 11, 2011 @ 7:46 am

Thanks for making my point Dan. Chesrownn purchased an option on the 106 acre bundle and assigned values to optimize his return. He had anxious willing buyers, which by the way, are the best type to have. They thoroughly overpaid with their over zealous exuberance.

Comment by Ancientemplar — July 11, 2011 @ 7:48 am

Sorry Bill it was your explanation.

Comment by Ancientemplar — July 11, 2011 @ 7:49 am

Ancientemplar,

That’s okay — I have to check my driver’s license every now and then to make sure I know who I am.

That is exactly what happened. One very telling detail is that the Foundation and NIC sought to have the land zoned C-17, commercial. Why? The existing campus is zoned R-17 and through judicious application of special use permits, has been able to meet its mission requirements as a community college. Testifying before the CdA Planning Commission, both Lyons and Wold said that it needed to be C-17 to give future NIC Trustees “greater flexibility.” Of course, our ever-compliant Planning Commissioners didn’t ask, “Greater flexibility to do what?” How would C-17 zoning improve the quality of vocational training and education programs? Of course, C-17 zoning was one of the conditions that had to be met in order to justify the appraisal supporting the $10 million purchase price. C-17 zoning also increases the land’s value when NIC wants to sell or swap some or all of it.

Comment by Bill — July 11, 2011 @ 8:01 am

Wallypog,

At the time District Judge John T. Mitchell shut off our discovery, the “Lease Agreement” was the only document disclosed to us that resulted in the property title transferring to NIC from the Foundation. To our knowledge, the “Lease Agreement” was not supplemented or amended.

Comment by Bill — July 11, 2011 @ 8:04 am

Bill, one thing missed here is the fact that had NIC put the issue to a vote, and received the super majority required, it would have resulted in a levy of new taxes on all County residents. With the lease arrangement, the only obligated funds were the annual installments, which NIC was able to make with existing funds. Result: no tax increase.

I, for one, am pleased whenever a government can cover its costs without increasing my taxes. I would think most people would agree to that, especially if they live in high-end homes and pay more than their share of the tax burden already.

I know you dislike the method NIC used to acquire the property, but I hope you can at least give them some credit for doing so without raising our taxes.

Comment by JohnA — July 11, 2011 @ 8:30 am

JohnA,

No, it could have been funded exactly the same way it was — only it would have been constitutionally done with voter approval or judicial confirmation.

Unlike you, I do not believe that it is appropriate to circumvent the Idaho Constitution or statutes to save money. Judicial approval of such a scheme amounts to amending the Constitution from the bench.

Not everyone lives in your situational ethics world, so no, I will not give either NIC or the Foundation credit for doing indirectly that which the Idaho Constitution forbade them to do directly.

Comment by Bill — July 11, 2011 @ 8:40 am

It resent the phrase ‘situational ethics’, Bill. First, you contend that the acquisition was illegal, which removes the issue of ethics entirely. Second, if it was illegal, the courts should make them undo the arrangement. Finally, if you want to make it illegal, you should ask your local legislators to propose a law that would prohibit it. That’s your right as a citizen of this state, just as it is my right to comment on the issue without personal attack.

Comment by JohnA — July 11, 2011 @ 8:55 am

JohnA,

Resent it all you want to, but in essence you said you would overlook their violating the law if it didn’t result in taxes being raised. Your position amounts to situational ethics.

I resent NIC overpaying about $6.7 million (property tax money) in rent to a private corporation, making no effort to recover the overpayment, and getting absolutely nothing in return for that overpayment.

As to your second point, you misstate the law. I suggest you do some case law research starting with Williams v City of Emmett.

It already is illegal, so no new law is necessary.

Comment by Bill — July 11, 2011 @ 9:19 am

Bill, if it is illegal why have at least one prominent bond counsel said otherwise? And, why has this particular transaction not been undone?

Comment by JohnA — July 11, 2011 @ 9:35 am

JohnA,

Federal prisons are filled with people whose prominent counsel said they were not guilty.

You can find the answer to your second question in Williams v. City of Emmett.

Comment by Bill — July 11, 2011 @ 9:51 am

‘Federal prisons are filled with people whose prominent counsel said they were not guilty.’

Not to the point where the career of that counsel ended because of bad advice, which is what happens when bond attorneys are wrong. In my instance the prominent attorney was named U.S. Attorney by President Obama.

Comment by JohnA — July 11, 2011 @ 10:03 am

But NIC did raise taxes — and tuition — to help fund this thing. NIC took foregone years ago and then they took the maximum 3% every year to get enough money to pay for a real estate purchase. There is no proof in the NIC budget that the money went toward anything other than this land purchase.

The ends do not justify the means.

Remember: There has been no act of evil done in this world that did not originate with the best of intentions. The means matter.

Comment by Dan — July 11, 2011 @ 10:17 am

John A.”I, for one, am pleased whenever a government can cover its costs without increasing my taxes. I would think most people would agree to that, especially if they live in high-end homes and pay more than their share of the tax burden already.”

Gee, dumb me but I thought every one paid taxes based upon the assessed value of their homes to sufficiently cover the budgets of the taxing districts. I didn’t realize that the people that can afford to live in high end homes PAID MORE THAN THEIR FAIR SHARE.

Comment by Ancientemplar — July 11, 2011 @ 10:18 am

JohnA,

I’m guessing you’re referring to Mike Ormsby?

And as Dan pointed out, NIC did increase taxes and fees to come up with the cash at the front end.

Comment by Bill — July 11, 2011 @ 10:32 am

“Not to the point where the career of that counsel ended because of bad advice, which is what happens when bond attorneys are wrong. In my instance the prominent attorney was named U.S. Attorney by President Obama.”

So Ormsby is acceptable to the Chicago mob, eh? That is NOT a resounding endorsement of his ethics. At least not in my humble opinion.

Comment by Pariah — July 11, 2011 @ 11:37 am

Ancient, it is a fact that properties with the highest value tend to pay the highest taxes. The owners do not cost the system any more than a low-value house (and in fact often cost it less in terms of police and fire response) but the owners pay more. It is a very inequitable way to fund government but it is what we have.

Comment by JohnA — July 11, 2011 @ 1:37 pm

Bill, are you making the case that Williams defines the lease arrangement as illegal? If so, why hasn’t a judge made NIC undo the deal? I think I might have missed a step here somewhere.

Comment by JohnA — July 11, 2011 @ 5:16 pm

Dan, not only did NIC take Foregone taxes for the purchase of this property, but they chose to add the foregone amount to their budget’s bottom line, so the taxpayers would have to pay the amount year after year after year. When they took Foregone, I asked Trustee Mic Armon (now Chairman), if they would add the amount to their permanent budget and he told me he wasn’t sure at that time. He told me they needed the Foregone to buy the land.

Comment by mary — July 11, 2011 @ 5:31 pm

JohnA,

In Comment 25, you said, “Second, if it was illegal, the courts should make them undo the arrangement.” You raised that same issue with your question in Comment 35. Williams addresses your statement and question directly. That’s where the answer is, so, read it until you understand it.

Comment by Bill — July 11, 2011 @ 8:07 pm

John, the high end owners pay more so its more than their fare share? It is their fare share. Its the same proportion of their value. Its not based on usage. You can’t have it both ways John,change the law if you don’t like it. That’s what you keep saying on this website. Hello?

Comment by Ancientemplar — July 11, 2011 @ 8:27 pm